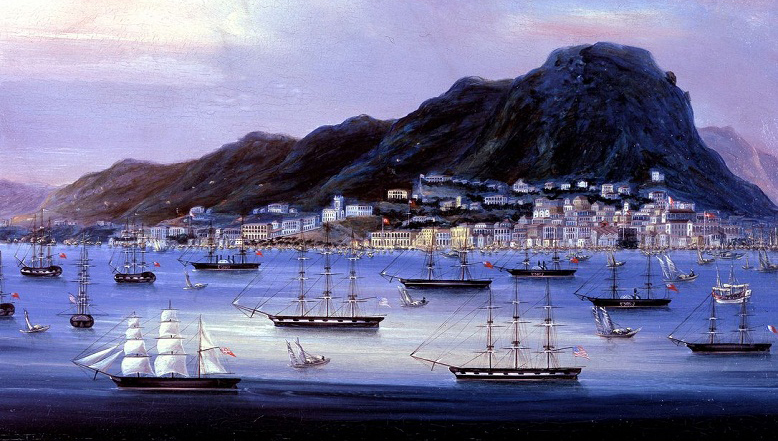

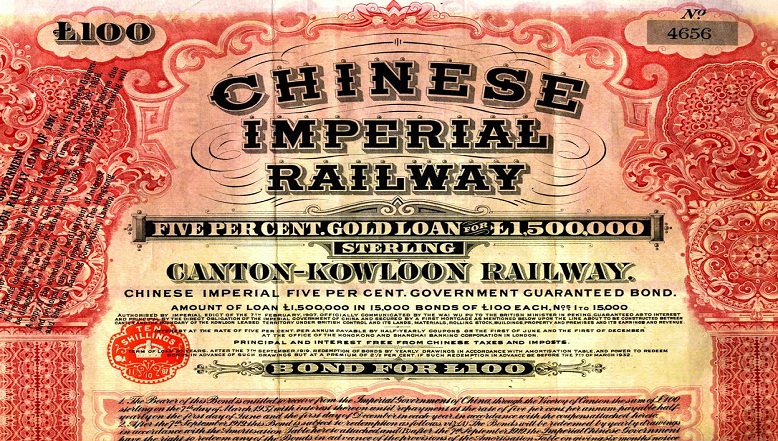

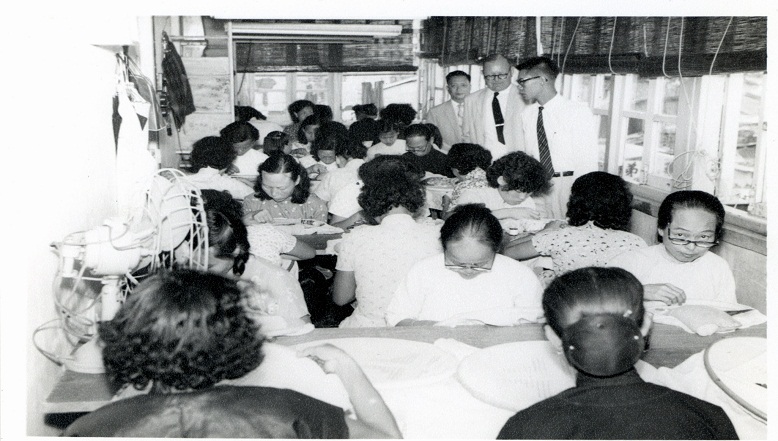

The Hongkong and Shanghai Banking Corporation Limited opened in Hong Kong on 3 March 1865 and in Shanghai one month later. It was the first locally owned bank to operate according to Scottish banking principles.

HSBC in Oman

Our services

HSBC Middle East Ltd - Oman Branch is an onshore wholesale banking business with deposit-taking, credit and lending capability for public sector and wholesale clients.

We offer local and foreign currency vanilla corporate and transactional banking products and services. The offering covers Global Payments Solutions, Global Trade Solutions, Financing & Advisory, Global Markets and HSBC Securities Services.

Our core focus is international wholesale clients in order to connect Oman with opportunities around the world and vice versa.

Our branch

Office 106, 1st Floor

HSBC Salam Square (North Tower)

Dohat Al Adab Street

Muscat

Our CEO

Elie Maroun El Asmar

Our history in Oman

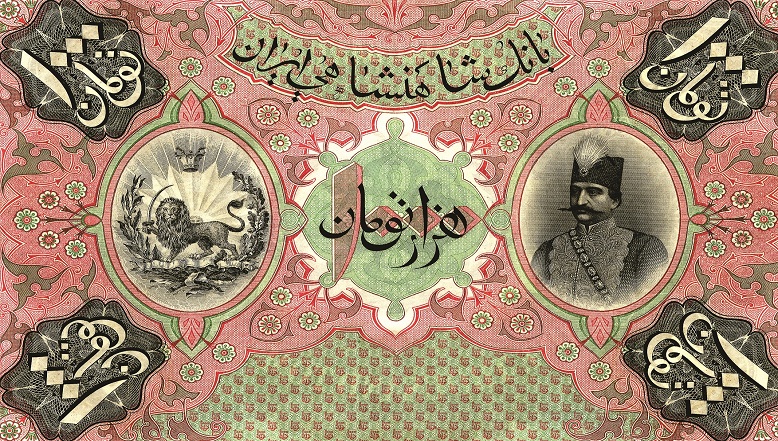

We have been present in Oman since 1948 and for two decades we were the only bank operating in the country. Over the years we have delivered a number of ‘firsts’ for Oman, including assisting with the first issue of the Omani currency in 1970.

In June 2012, HSBC Bank Middle East’s Oman operations merged with Oman International Bank, an institution with a rich heritage, which was listed on the Muscat Securities Market. The new bank was renamed HSBC Bank Oman S.A.O.G.

From 2012 until August 2023, we were represented in Oman by HSBC Bank Oman S.A.O.G.

In 2023, HSBC Oman completed a merger with Sohar International Bank. Following the merger, in May 2024, HSBC Bank Middle East Limited-Oman Branch opened its doors, beginning a new chapter of HSBC’s presence in the Sultanate. The branch connects internationally focused enterprises in Oman with the rest of the world and vice versa.

Our branch in Oman

Take a tour of our new wholesale branch in Muscat, where our teams are supporting the needs of our Global Banking and Commercial Banking clients in the Sultanate.

Sustainability is unlocking business growth Opens in new window

The commercial case for sustainability has reached a critical mass, placing it firmly on the agenda of many businesses globally, says Natalie Blyth.

Carers need more tailored financial support Opens in new window

We have a responsibility to step in and address the financial challenges faced by carers – and to help them find the tailored financial support that they need, says Steve Reay.

Younger generations investing with greater confidence Opens in new window

Younger generations of savvy, digital natives are investing in their financial futures with more confidence and control than older generations, says Jenny Wang.